ttass.ru

Overview

Prdgx Mutual Fund

The investment seeks dividend income and long-term capital growth primarily through investments in stocks. Strategy. The fund normally invests at least 65% of. T. Rowe Price Dividend Growth Fund, Inc. (PRDGX) Dividends Dates And Yield - See the dividend history dates, yield, and payout ratio for T. Rowe Price. The Fund seeks to provide increasing dividend income over time, long-term growth of capital, and a reasonable level of current income through investments. T. Rowe Price Dividend Growth Fund, Inc. News & Analysis. Featured Article. Best Dividend Mutual Funds for Low fees. Access live pricing, performance, portfolio and fund info for T. Rowe Price Dividend Growth Fund Inc (PRDGX) Mutual Fund. Explore Our Financial Data >. Only daily data (3M Chart and above) is available for Mutual Funds. Price Performance. See More. Period, Period Low. Analyze the Fund T. Rowe Price Dividend Growth Fund having Symbol PRDGX for type mutual-funds and perform research on other mutual funds. T. Rowe Price Dividend Growth Fund PRDGX has $ BILLION invested in fossil fuels, % of the fund. The fund has returned percent over the past year, percent over the past three years, percent over the past five years, and percent over. The investment seeks dividend income and long-term capital growth primarily through investments in stocks. Strategy. The fund normally invests at least 65% of. T. Rowe Price Dividend Growth Fund, Inc. (PRDGX) Dividends Dates And Yield - See the dividend history dates, yield, and payout ratio for T. Rowe Price. The Fund seeks to provide increasing dividend income over time, long-term growth of capital, and a reasonable level of current income through investments. T. Rowe Price Dividend Growth Fund, Inc. News & Analysis. Featured Article. Best Dividend Mutual Funds for Low fees. Access live pricing, performance, portfolio and fund info for T. Rowe Price Dividend Growth Fund Inc (PRDGX) Mutual Fund. Explore Our Financial Data >. Only daily data (3M Chart and above) is available for Mutual Funds. Price Performance. See More. Period, Period Low. Analyze the Fund T. Rowe Price Dividend Growth Fund having Symbol PRDGX for type mutual-funds and perform research on other mutual funds. T. Rowe Price Dividend Growth Fund PRDGX has $ BILLION invested in fossil fuels, % of the fund. The fund has returned percent over the past year, percent over the past three years, percent over the past five years, and percent over.

The fund seeks dividend income and long-term capital growth primarily through investments in stocks.

Top Mutual Funds · Options: Highest Open Interest · Options: Highest Implied Rowe Price Dividend Growth (PRDGX). Follow. (%). At close: 8. T. Rowe Price Dividend Growth Fund. Shareclass. T. Rowe Price Dividend Growth (PRDGX). Type. Open-end mutual fund. Manager. PRDGX T. Rowe Price Dividend Growth Fund Inv. Dividend Overview & Grades. Follow. $ (%)09/06/ Mutual Fund | $USD | NAV. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. The Schedule 13D indicates that the investor holds (or held). The fund normally invests at least 65% of its total assets in stocks, with an emphasis on stocks that have a strong track record of paying dividends. Rowe Price Dividend Growth Fund, Inc.: (MF: PRDGX). (NASDAQ Mutual Funds) As of Aug 16, PM ET. Add to portfolio. $ Mutual Fund Profile. Breaking News. T Rowe Price Dividend Growth Fund. PRDGX. Price. Last Close, $ + 0 %. Week High, $ Week Low, $ This data covers open-end mutual funds and exchange-traded funds domiciled Rowe Price Dividend Growth Fund. TRZDXTADGXPDGIXPRDGX. %. tobacco. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. Schedule 13G indicates a passive investment of over 5%. PRDGX. and more than other mutual funds. Find out T. Rowe Price Dividend Growth's MAXrating - the one number you need to know before buying or selling a mutual. Key Fund Data ; Turnover %. 16% ; Portfolio Style. Growth & Income ; Inception Date. December 30, ; Fund Status. Open ; Minimal Initial Investment. $2, The fund normally invests at least 65% of its total assets in stocks, with an emphasis on stocks that have a strong track record of paying dividends or that are. Investment Objective. The Fund seeks to provide increasing dividend income over time, long-term growth of capital, and a reasonable level of current income. Get PRDGX mutual fund information for T.-Rowe-Price-Dividend-Growth-Fund, including a fund overview,, Morningstar summary, tax analysis, sector allocation. T. Rowe Price Funds, Ticker Symbol, Income Dividend Per Share. Balanced, RPBAX, $ Dividend Growth, PRDGX, $ Equity Income, PRFDX, $ SUMMARY PROSPECTUS. May 1, T. ROWE PRICE. Dividend Growth Fund. PRDGX. PDGIX. TADGX. TRZDX. Investor Class. I Class. Advisor Class. Rowe Price Dividend Growth Fund, Inc.: (MF: PRDGX). (NASDAQ Mutual Funds) As of Aug 16, PM ET. Add to portfolio. $ USD. + (%). Zacks MF. Get T. Rowe Price Dividend Growth Fund (PRDGX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Find a T. Rowe Price mutual fund that fits your needs. Use our mutual fund research tool to search and compare funds based on what matters most to you. T. Rowe Price Dividend Growth Fund, Inc. (PRDGX) Dividends Dates And Yield - See the dividend history dates, yield, and payout ratio for T. Rowe Price.

Trading Android

Our variety of apps provide multiple services to help you manage your money as well as your benefits whenever - and wherever - you want. The best stock trading apps: Public, E*TRADE, J.P. Morgan Self-Directed Investing, SoFi Active Investing, Webull, Ally Invest, Firstrade, Robinhood. Download our free, award-winning Android or Apple mobile trading app and start trading thousands of markets from anywhere in the world. To start trading the financial markets on Android, visit the Google Play Store and download our CMC Markets app. Once you have an account with us, you will. Seize opportunities anytime, anywhere with a choice of two full-featured mobile trading apps built from the ground up for traders and investors on the go. So much to look forward to · Enter the make/model or IMEI number of your qualifying trade-in during checkout. · Backup your data and perform a factory reset of. Optimized for your phone or other mobile device, the NinjaTrader futures trading app for Android and iPhone allows you to connect to the markets easily and. Trading in your phone, tablet, smartwatch or other device is easy with our Device Trade-in Program. Just tell us the device and its condition and you'll get a. Trade On-the-Go. Access over markets worldwide right from the palm of your hand with the IBKR mobile app! Powerful Trading Tools Right in Your Pocket. Our variety of apps provide multiple services to help you manage your money as well as your benefits whenever - and wherever - you want. The best stock trading apps: Public, E*TRADE, J.P. Morgan Self-Directed Investing, SoFi Active Investing, Webull, Ally Invest, Firstrade, Robinhood. Download our free, award-winning Android or Apple mobile trading app and start trading thousands of markets from anywhere in the world. To start trading the financial markets on Android, visit the Google Play Store and download our CMC Markets app. Once you have an account with us, you will. Seize opportunities anytime, anywhere with a choice of two full-featured mobile trading apps built from the ground up for traders and investors on the go. So much to look forward to · Enter the make/model or IMEI number of your qualifying trade-in during checkout. · Backup your data and perform a factory reset of. Optimized for your phone or other mobile device, the NinjaTrader futures trading app for Android and iPhone allows you to connect to the markets easily and. Trading in your phone, tablet, smartwatch or other device is easy with our Device Trade-in Program. Just tell us the device and its condition and you'll get a. Trade On-the-Go. Access over markets worldwide right from the palm of your hand with the IBKR mobile app! Powerful Trading Tools Right in Your Pocket.

The award-winning mobile trading app * for committed traders. Get the functionality of the web platform in your pocket: open, close or modify trades with ease. Interactive Brokers provides investors with a mobile interface to monitor their account, trade, configure two-factor authentication and more. This lesson will. Download our free, award-winning Android or Apple mobile trading app and start trading thousands of markets from anywhere in the world. Manage your positions; find quotes, charts, and studies; get support; and place trades easily and securely—all right from your phone or tablet. Access products. E*TRADE Mobile app · For Apple® and Android™ devices, including the Apple Watch® and leading tablet devices · Named "Best in Class" mobile app by ttass.ru Check the trade-in value of your phone. Confirm eligibility, then shop devices and promotions. Enter a digit IMEI number. Mobile trading allows investors to access trading platforms from their telephones rather than being confined to traditional trading methods via computer. Such. Discover the Exness Trade App, your ultimate mobile trading app solution for seamless and efficient trading on the go. Trade confidently with Exness today. Download Trading For Android - Best Software & Apps · Binance: BTC, Crypto and NFTS · Binomo · MetaTrader 5 — Forex, Stocks · StormGain: Bitcoin Wallet Crypto. Place trades on the move with Intertrader. The Intertrader+ apps for iOS and Android let you buy and sell markets from your smartphone or tablet. Simply tap to. Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. From stocks to cryptocurrencies. News, charts and trading ideas from global traders. Discover IG's award-winning trading app1. Trade wherever, whenever with our user-friendly mobile trading platform. You'll receive full dealing functionality on. FXCM APPS. One of the best ways to simplify your trading is with indicators, scripts and other apps. Trading Station comes pre-loaded with dozens of helpful. Get the power of thinkorswim desktop in the palm of your hand with thinkorswim mobile. It's a one-stop trading app that's optimized specifically for mobile. It's quick and easy to switch from Android to iPhone. Trade in your smartphone for credit. And transfer your stuff with a few taps. It's quick and easy to switch from Android to iPhone. Trade in your smartphone for credit. And transfer your stuff with a few taps. R MobileTrader is fully adapted to mobile devices, from smartphones to tablets. Download your all-in-one online trading station and start trading currency. The Medium Server is suitable for most traders' needs, and works well with Mobile. The Pro Dedicated Server is the BEST Performance you'll find in a Trading. Device trade-in value depends on the eligibility of the device traded in. Device trade-in credit will be issued as a refund back on the credit card (up to

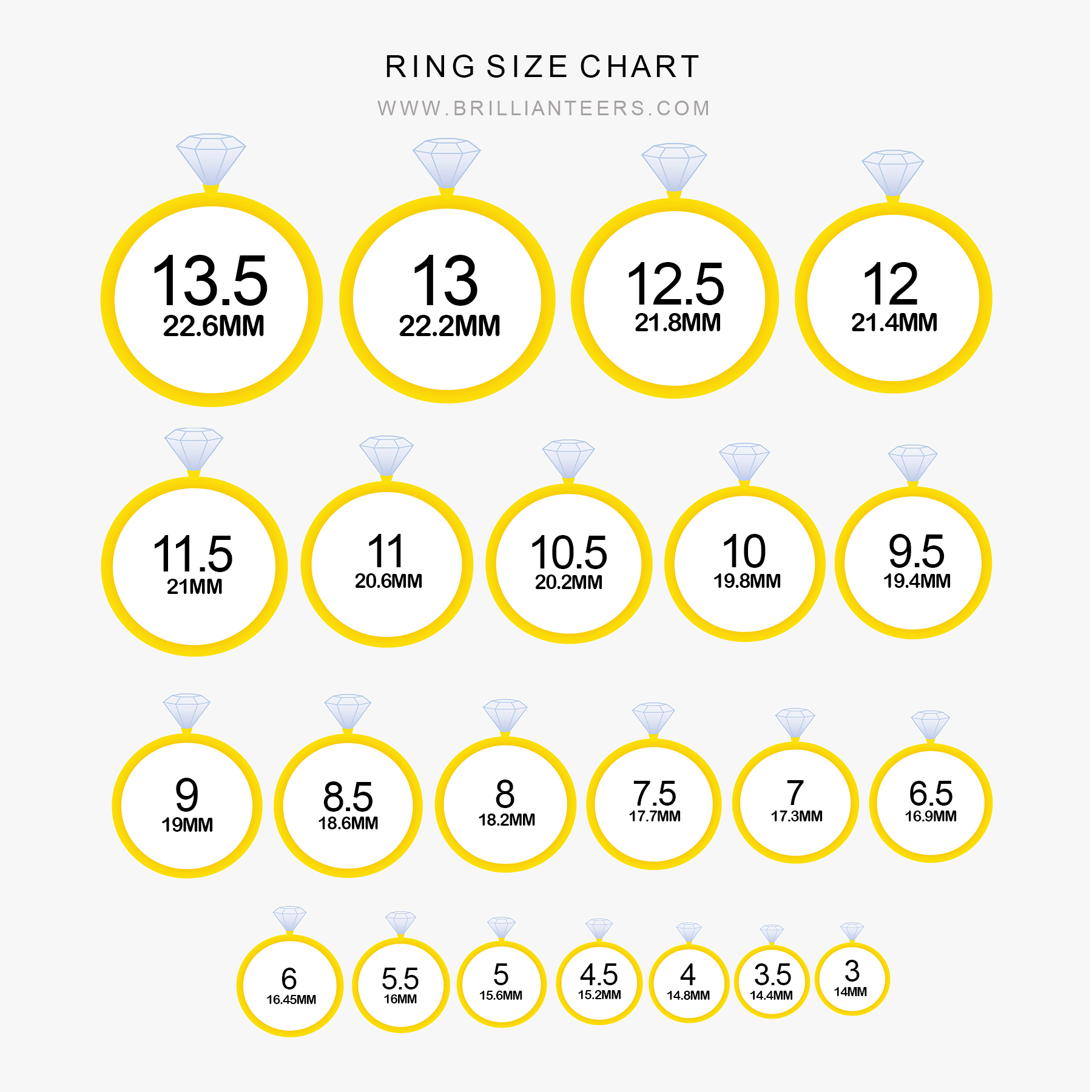

How Much To Get A Ring Sized Up

How much does it cost to get a ring resized? It depends on several factors, including the type and amount of metal, how many sizes up or down it needs to move. Book an appointment now and get your ring on your finger the same day! From $75 and up. Z. Same-day sizing up or sizing down. I called my jeweler and they said they only resized for free during the first month. Now it's $35 and they ship it. I believe Kays said $30 and Zales said $ Or buy our ring sizer. Ring sizer laid on a tan plate in the sunlight. You Sign up for emails and texts to get first dibs on new arrivals, exclusive. An expert ring resizing work can cost somewhere between $10 to $+ contingent upon the type of the ring, the material, and the intricacy included. We will resize your ring once for free within the first year of your purchase, including free return shipping worldwide. If more than one resize is needed or. A basic resize that should be simpler will cost $10 to $60, while a complex resize can surpass $50 to $ For instance, rings containing white or yellow gold. If you need your ring resized up by more than half a size, the jeweler will cut the band, add in some metal and then make sure the band looks uniform and. Based on the current gold prices, my estimate of a general ring resizing job should cost around $50 – $ How much does it cost to get a ring resized? It depends on several factors, including the type and amount of metal, how many sizes up or down it needs to move. Book an appointment now and get your ring on your finger the same day! From $75 and up. Z. Same-day sizing up or sizing down. I called my jeweler and they said they only resized for free during the first month. Now it's $35 and they ship it. I believe Kays said $30 and Zales said $ Or buy our ring sizer. Ring sizer laid on a tan plate in the sunlight. You Sign up for emails and texts to get first dibs on new arrivals, exclusive. An expert ring resizing work can cost somewhere between $10 to $+ contingent upon the type of the ring, the material, and the intricacy included. We will resize your ring once for free within the first year of your purchase, including free return shipping worldwide. If more than one resize is needed or. A basic resize that should be simpler will cost $10 to $60, while a complex resize can surpass $50 to $ For instance, rings containing white or yellow gold. If you need your ring resized up by more than half a size, the jeweler will cut the band, add in some metal and then make sure the band looks uniform and. Based on the current gold prices, my estimate of a general ring resizing job should cost around $50 – $

Perhaps you have an itchy ring or it is causing irritation on your skin. From ring resizing to various metal options, here's how to fix some of the most common. Usually, it takes between 1 day and 1 week for a resizing. In reality, it only takes a jeweler about 10 or 20 minutes to resize a ring. However, they might not. The fee for ring resizing** is $, or $ if the item is Platinum. If the desired size is not listed in the pull down menu, please contact us for size. In general, resizing a ring can range anywhere from $30 to $ or more. I had a ring resized a while back, and I decided to go with Blue Nile. How much does it cost to size or resize a ring up? Ring resizing up starts from $40 + plus shipping and can go up depending on the type of metal and/or the. Most rings will likely take one to two weeks to complete, shares jeweler Jennifer Gandia, with the average price range being $20 for a simple resizing or more. No matter the reason, many people have a lot of questions surrounding getting their rings resized A simple band that only needs to go up a half size. We got my engagement ring and wedding band at Kay Jewelers and I heard many bad things about sending your ring in to get it resized and I refuse to do. How Much Does it Cost to Resize a Ring in the UK? · Platinum rings – up to £ · 22 ct and 18 ct gold rings – up to £ · 9 ct gold rings – up to £80 · Silver. Adding sizing beads to your ring is a very simple process: The jeweler simply solders two small metal bumps on the inside of the band. This is a prime way to. The general rule of the thumb is, a ring can be modified up to a maximum of two sizes. IMPORTANT: Read This First! ring too small for finger. This ring is too. Ring Size Down (Up to 3 sizes), $ ; Ring Size Up (Up to 3 sizes), $ ; Ring Sizing Beads, $ ; Ring Sizing Spring Shank, $ Every engagement ring is different, meaning there's no set cost for getting your engagement ring resized. Most of the time, the jeweler you use to purchase your. We will resize your ring once for free within the first year of your purchase, including free return shipping worldwide. If more than one resize is needed or. To add metal, a jeweller will cut into the metal and then add an extra bit of metal to make it bigger. When the metal has been matched up and placed to the. Get the on what resizing a ring entails Buy Online, Pick Up In-Store · Protection Plans · Price Match Guarantee · Repairs And Maintenance · Diamond Trade. Performed on a bracelet, necklace or ring, this service consists of increasing or reducing the size of the item as much as possible without affecting its. However, ring sizes vary from jeweler to jeweler (usually up to ½ a size). We recommend getting sized by the jeweler you purchase your ring from to make sure. When a jeweler makes a ring size smaller, they will cut out a piece of the ring band and form it into a perfect circle. Then they will join the two pieces back. Your first ring resize is always free. The price you are paying is for your shipping / insurance BACK to you, within the USA, and your resize costs.

Best 401 K Rollovers

Roll it into a new (k) plan The pros: Assuming you like your new plan's costs, features, and investment choices, this can be a good option. Your savings. Traditional IRA: Like the traditional (k), your contributions to a traditional IRA are tax-free; the money is taxed only when you withdraw it during. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. It may or may not be in your best interest to move your (k), (b), plan, TSP, or other company retirement plan when you leave your company or retire. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. k rollover to an IRA. This is the most common and well known, thanks in part to Fidelity's non-stop marketing. You can do a k rollover into an IRA account. If you are transferring a traditional (k) account, the simplest move is a transfer to a traditional IRA. You must pay taxes on the money and its earnings. Find a new home for your old (k), , or (b) by rolling it over to a Prudential IRA. Talk with a FINANCIAL PROFESSIONAL to get an idea of the best course. ttass.ru's picks for the best rollover IRA providers of offer a range of investment options, low fees and robust resources for managing your own. Roll it into a new (k) plan The pros: Assuming you like your new plan's costs, features, and investment choices, this can be a good option. Your savings. Traditional IRA: Like the traditional (k), your contributions to a traditional IRA are tax-free; the money is taxed only when you withdraw it during. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. It may or may not be in your best interest to move your (k), (b), plan, TSP, or other company retirement plan when you leave your company or retire. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. k rollover to an IRA. This is the most common and well known, thanks in part to Fidelity's non-stop marketing. You can do a k rollover into an IRA account. If you are transferring a traditional (k) account, the simplest move is a transfer to a traditional IRA. You must pay taxes on the money and its earnings. Find a new home for your old (k), , or (b) by rolling it over to a Prudential IRA. Talk with a FINANCIAL PROFESSIONAL to get an idea of the best course. ttass.ru's picks for the best rollover IRA providers of offer a range of investment options, low fees and robust resources for managing your own.

If you can bear the financial burden of converting from K to Roth IRA and you are younger than ish years, it will be a better option for. You can roll over your (k) funds into an IRA. A (k) plan is an excellent, tax-advantaged way to save for retirement. But you may wonder what happens to. Open an IRA at Fidelity or Vanguard and roll the old (k) into it. If you made any Roth (k) contributions you'll need to open a Roth IRA. The easiest and safest way to roll over your (k) into an IRA is with a direct rollover from the financial institution that manages your (k) plan to the. Discover your k Rollover Options: transferring, tax advantages, fees, and more. Learn how to roll over your old k into an IRA to maximize your. Discover your k Rollover Options: transferring, tax advantages, fees, and more. Learn how to roll over your old k into an IRA to maximize your. Roll your old (k) over into your new employer's plan. If your new employer offers a retirement plan, such as a (k), this might be a good option because it. Here's how you can easily roll over your (k), why you should, and the rare instances where it might make sense to track it but leave it as is. k rollover IRA accounts are designed for individuals. They are fairly easy to work with when you need to take a distribution or manipulate the investments. You can roll over your (k) funds into an IRA. A (k) plan is an excellent, tax-advantaged way to save for retirement. But you may wonder what happens to. plans include, for example, profit-sharing, (k), money purchase, and For more information regarding retirement plans and rollovers, visit Tax Information. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. You'll need to decide where to move the money in your (k). You have a few options, each of which have their own benefits and drawbacks. It is possible to transfer a rollover IRA into a Canadian RRSP, but this is often not the best solution for US citizens because it likely results in double. An IRA may provide more flexibility and a wider range of investment options in addition to preventing current income taxes and possible additional taxes for. You can roll over funds from a (a) into a qualified (a) plan with another employer, (if the employer allows rollovers), as well as into a traditional IRA. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open. As mentioned above, it's usually best to request a direct rollover. With that approach, your former employer provides a check payable directly to your next. A (k) with even a modest fee may cost you tens of thousands of dollars over time. The savings from rolling into a managed Betterment IRA of low-cost. Three of the options – leaving your money in the plan, moving it to your new employer's plan and rolling over to an IRA – will allow you to continue to earn.

Learning Foreign Exchange Trading

Forex trading centers around the basic concepts of buying and selling. Our guide explores how and when to buy and sell currencies using signals and analysis. Our free online trading course is designed to help you learn how to trade Forex, boosting your trading knowledge in just three short steps. From online courses to individual training, these forex classes can provide a beginner trader with all the tools required for a profitable experience. A bachelor's degree is required. Any experience in a trading environment is valued, as is any work that demonstrates the ability to work hard, make fast and. Learn about the foreign exchange market and currencies trading. Forex trading steps · Choose a currency pair to trade · Decide whether to 'buy' or 'sell' · Set your stops and limits · Open your first trade · Monitor your position. Start your trading education with ttass.ru Learn how to trade with our interactive online trading courses ranging from beginner to advanced. In summary, here are 10 of our most popular forex courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers · Forex -. Learning to trade forex as a beginner can be tough. See our forex trading guide for beginners, which provides essential knowledge for any new forex trader. Forex trading centers around the basic concepts of buying and selling. Our guide explores how and when to buy and sell currencies using signals and analysis. Our free online trading course is designed to help you learn how to trade Forex, boosting your trading knowledge in just three short steps. From online courses to individual training, these forex classes can provide a beginner trader with all the tools required for a profitable experience. A bachelor's degree is required. Any experience in a trading environment is valued, as is any work that demonstrates the ability to work hard, make fast and. Learn about the foreign exchange market and currencies trading. Forex trading steps · Choose a currency pair to trade · Decide whether to 'buy' or 'sell' · Set your stops and limits · Open your first trade · Monitor your position. Start your trading education with ttass.ru Learn how to trade with our interactive online trading courses ranging from beginner to advanced. In summary, here are 10 of our most popular forex courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers · Forex -. Learning to trade forex as a beginner can be tough. See our forex trading guide for beginners, which provides essential knowledge for any new forex trader.

A bachelor's degree is required. Any experience in a trading environment is valued, as is any work that demonstrates the ability to work hard, make fast and. That's what learning grants us are different perspectives, you'll need multiple perspectives to tackle the FX markets. To start I'd familiarize. Forex trading is the conversion of one currency into another. Learn how forex trading works, what moves the foreign exchange markets and how they work. The Forex Trading Coach by Andrew Mitchem, from a dairy farmer to a successful forex trader will share his success stories in forex trading. The forex market is traded around the globe, virtually around the clock. Learn more about forex trading with this retail forex guide for beginners. The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign. These free online Forex courses will teach you everything you need to know about Forex. Let experienced professionals teach you how to leverage foreign exchange with a Forex trading course on Udemy. We can help you open a gateway to global. Trading forex using leverage allows you to open a position by putting up only a portion of the full trade value. You can also go long (buy) or short (sell). Let experienced professionals teach you how to leverage foreign exchange with a Forex trading course on Udemy. We can help you open a gateway to global. Learn forex trading at ttass.ru's learning center. We offer online trading courses, interactive quizzes and a forex glossary. Step 1: Learn About the Forex Market · Step 2: Choose How You Want to Trade Forex · Step 3: Choose a Broker · Step 4: Open a Trading Account · Step 5: Prepare a. FX Academy is unique as it provides high-quality education for free, ensuring everyone has equal access to Forex education. The courses are well-written by. Learning Forex Trading Basics · Step 1 Understand basic forex terminology. · Step 2 Read a forex quote. · Step 3 Decide what currency you want to buy and sell. About this app. arrow_forward. ☆ Learn stock and forex trading in a friendly, risk-free trading simulator. ☆ Learn Faster. Trade Smarter. And have fun while. Welcome! Are you new to trading forex? The School of Pipsology is our free online course that helps beginners learn how to trade forex. If you've always wanted. Learning Forex Trading – Pips. Generally, the smallest fluctuation in an exchange rate between two currencies is called a “pip”. With most currency pairs, which. Begin your trading education with our Foundational Trading Knowledge course. Learn about a variety of markets like foreign exchange, commodities and equities. To learn how to start forex trading, you'll want to start with the fundamentals. Here are some key concepts to start with: The foreign exchange market (FX). What you'll learn · Explore the FX market such as its participants and motives, products, risks, margin accounts, related trading platform methods and tools.

How Old Do I Have To Be To Buy Stocks

How Old Do You Have to Be to Trade Stocks? You must be at least 18 years old in the United States to open a brokerage account and trade stocks. · Is It Possible. The only stock I do invest in is gold because gold tends to be very valuable in an economic crisis. So before investing in stocks, do your. Generally speaking, investors should expect to be at least 18, but some young investors may have to wait until their 21st birthday before they can make their. Rewards: If you want to kick it up a few notches, you can invest in stocks and stock funds and enjoy their potentially much higher returns – and do it all tax-. By clicking the link below, the viewer understands this communication does not constitute an offer to sell or the solicitation of an offer to buy, nor shall. In TreasuryDirect, you may open an account and buy Treasury marketable securities for yourself (an individual registration). With an individual registration. Unfortunately a 13 year old cannot purchase investments in their name. An RESP could work but it would need to be opened by your nephews parents. Computershare Investment Plan is a Direct Stock Purchase and Dividend Reinvestment Plan for McDonald's Corporation. This is a convenient method to invest in. Legally to invest in stocks in your own Demat A/c. You must be 18 years old. An you must have PAN card to open a Demat account. There are. How Old Do You Have to Be to Trade Stocks? You must be at least 18 years old in the United States to open a brokerage account and trade stocks. · Is It Possible. The only stock I do invest in is gold because gold tends to be very valuable in an economic crisis. So before investing in stocks, do your. Generally speaking, investors should expect to be at least 18, but some young investors may have to wait until their 21st birthday before they can make their. Rewards: If you want to kick it up a few notches, you can invest in stocks and stock funds and enjoy their potentially much higher returns – and do it all tax-. By clicking the link below, the viewer understands this communication does not constitute an offer to sell or the solicitation of an offer to buy, nor shall. In TreasuryDirect, you may open an account and buy Treasury marketable securities for yourself (an individual registration). With an individual registration. Unfortunately a 13 year old cannot purchase investments in their name. An RESP could work but it would need to be opened by your nephews parents. Computershare Investment Plan is a Direct Stock Purchase and Dividend Reinvestment Plan for McDonald's Corporation. This is a convenient method to invest in. Legally to invest in stocks in your own Demat A/c. You must be 18 years old. An you must have PAN card to open a Demat account. There are.

Stocks & ETFs. Can I trade penny stocks or other securities that aren't listed on a stock exchange? If you intend to purchase securities - such as stocks Market conditions that cause one asset category to do well often cause another asset category to have. Your guide to placing your first stock order. Do your research. Learn the basics. Enter your order. These are just some of the simple steps to help you get. How investing in shares works. Buying shares (stocks, securities or equities) makes you a part-owner of a company. As a shareholder, you can get dividends. You need to be 18 to buy stocks in every state in the nation (and in most it's 21!). However, you can still get started early if you have the time and know. Teenagers can begin trading stocks using mock, virtual or dummy portfolios without fear of making costly mistakes. There are free trading platforms that use. The old rule of thumb used to be that you should subtract your age from - and that's the percentage of your portfolio that you should keep in stocks. How old do you have to be to invest? If you're under the age of majority (18 or 19, depending on which province or territory you're in), you'll need a parent. Stocks · Overview · Trading Stocks at Schwab · Extended Hours Trading What platforms do I have access to now that my account has moved to Schwab? Without this, you cannot execute stock trading. Therefore, you have to have reached the age of 18 years to buy stocks. Moreover, to create a demat account and a. You can only begin investing at In fact, most brokers have '18 and above' as their age restriction when setting up an account. To open a trading account, you must be the age of majority in your province or territory. In Ontario, this is age how long do you have to do it? You'll often hear financial experts talk about the importance of diversification. This means buying more than one stock, so. Median stock market holdings for families across income levels, race, ethnicity, and ages. More than half of U.S. families have some level of investment in the. Stock · How can I get the current Apple stock price? · Does Apple pay a cash dividend? · Does Apple have a share repurchase program? · Can I purchase stock directly. Using a buy-and-hold strategy, you would have recouped your losses by , even without making additions to your original stock market investment. With. To buy stock using Cash App Investing: Stock can be purchased using the funds in your Cash App balance. If you do not have enough funds available, the. Retail investors can buy and sell stock on the same day—as long as they don Some people want to trade actively but either have no interest in. Allocate the adjusted basis of the old stock between the old and new stock on a lot by lot basis. Do I need to pay taxes on the additional stock that I. You are at least 18 years old and have your permanent residence in Germany with tax liability in Germany. You have a European cell phone number and a SEPA bank.

Bonds That Pay Dividends

Seven Monthly Dividend Stocks to Consider ; Monthly Dividend Stock, Trailingmonth Dividend Yield* ; Gladstone Capital Corp. (ticker: GLAD), % ; Dynex. The issuer will generally have to stop paying the common stock dividend before it would stop the payments on preferreds. For traditional preferred stock. Normally investing primarily in companies that currently pay, or have a historical record of paying, dividends. Investing in either "growth" stocks or "value". The distribution rate is not estimated to include a return of capital. The Fund intends to declare dividends daily, and pay dividends monthly, usually on the. Daily dividend factor (date) - Daily dividend distributed by a money market mutual fund. Default - Failure of a debtor to make timely payments of interest and. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. Learn about which types of mutual funds pay the highest dividends, including how dividend stock and bond funds generate the highest dividend yields. Dividend distributions from a mutual fund are taxable to you as ordinary income and capital gain distributions are usually taxable as capital gains. Bond funds typically pay higher dividends than CDs and money market accounts. Most bond funds pay out dividends more frequently than individual bonds. Seven Monthly Dividend Stocks to Consider ; Monthly Dividend Stock, Trailingmonth Dividend Yield* ; Gladstone Capital Corp. (ticker: GLAD), % ; Dynex. The issuer will generally have to stop paying the common stock dividend before it would stop the payments on preferreds. For traditional preferred stock. Normally investing primarily in companies that currently pay, or have a historical record of paying, dividends. Investing in either "growth" stocks or "value". The distribution rate is not estimated to include a return of capital. The Fund intends to declare dividends daily, and pay dividends monthly, usually on the. Daily dividend factor (date) - Daily dividend distributed by a money market mutual fund. Default - Failure of a debtor to make timely payments of interest and. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. Learn about which types of mutual funds pay the highest dividends, including how dividend stock and bond funds generate the highest dividend yields. Dividend distributions from a mutual fund are taxable to you as ordinary income and capital gain distributions are usually taxable as capital gains. Bond funds typically pay higher dividends than CDs and money market accounts. Most bond funds pay out dividends more frequently than individual bonds.

Dividend funds. Dividend funds. Dividend funds offer reliability and convenience for investors. They are classic equity funds that place a particular focus on. When do I get the interest on my I bond? With a Series I savings bond, you wait to get all the money until you cash in the bond. Electronic I bonds: We pay. By automatically reinvesting dividends, investors purchase additional CEF securities that typically pay higher rates of return. Although there are. When you buy a U.S. savings bond, you lend money to the U.S. government. In turn, the government agrees to pay that much money back later - plus additional. These ETFs (exchange-traded funds) typically hold stocks that have a history of distributing dividends to their shareholders. The months indicated for dividends and capital gains paid represent the anticipated current year ex-dividend date schedule for all share classes. YTD (year-to-. A corporate bond is a debt security issued by a corporation backed by the payment ability of the company, which is typically money to be earned from future. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company. For example, when the fund's underlying stocks or bonds pay income from dividends or interest, the fund pays those profits, after expenses, to its shareholders. payment, which can be spent or reinvested in other bonds. Stocks can also provide income through dividend payments, but dividends tend to be smaller than bond. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. Bond funds allow you to buy or sell your fund shares each day. In addition, bond funds allow you to automatically reinvest income dividends and to make. the company has no similar obligation to pay dividends to shareholders. In a bankruptcy, bond investors have priority over shareholders in claims on the. Dividend statement will be accompanied by Tax Form Dividend payment history. Dividends are generally considered a reliable source of yield, and that's even more true during periods in which bonds have struggled to pay investors any. Unlike individual bonds, which usually make semiannual interest payments, bond funds usually make monthly distributions that can be paid directly to the. However, a bond mutual fund, which is an actively managed portfolio of different bonds, does not have a maturity date, nor are its dividend payments fixed. A. paying dividends, or make them smaller. When you buy a bond, you are lending money to the company. The company promises to pay you interest and to return. Dividend funds. Dividend funds. Dividend funds offer reliability and convenience for investors. They are classic equity funds that place a particular focus on. Top Highest Dividend Yield ETFs ; BIZD · VanEck BDC Income ETF, % ; XCCC · BondBloxx CCC-Rated USD High Yield Corporate Bond ETF, % ; SARK · Tradr 2X.

Toyota Extended Warranty Price List 2021

The average cost for an extended car warranty is $4, across all warranty levels with an average rate of $1, per year of coverage. Quotes we received from. Price List · Finance Calculator · Financing Packages · Toyota Insurance Package additional 3 years extended warranty is covered by UMW Toyota Motor Sdn. You have until the new car warranty is up (up to 3 years or 36, miles, which ever comes first) to buy the warranty from any Toyota dealership. A vehicle is a big investment. Protect it with Vehicle Protection Plans available from Nucar Toyota of North Kingstown. Learn more now. your standard coverage, as well as additional coverage options. BASIC WARRANTY. 48MO / 50K MI. WHICHEVER OCCURS FIRST. POWERTRAIN WARRANTY. 72MO / 70K MI. Extended Warranty Coverage (items 1, 2, 3 and 4 above) transferable at no cost for added resale value. All important information clearly spelled out in your. Platinum Protection provides the most protection TFS offers after your vehicle's warranty expires, including parts not covered in Gold and Powertrain plans. Car covers are warranted for 12 months from the date of purchase and do not assume any coverage under the Toyota New Vehicle Limited Warranty. View Inventory. Each Toyota Certified Used Vehicle is reconditioned to Toyota's exacting standards by Toyota dealer-trained technicians and backed by an extensive used car. The average cost for an extended car warranty is $4, across all warranty levels with an average rate of $1, per year of coverage. Quotes we received from. Price List · Finance Calculator · Financing Packages · Toyota Insurance Package additional 3 years extended warranty is covered by UMW Toyota Motor Sdn. You have until the new car warranty is up (up to 3 years or 36, miles, which ever comes first) to buy the warranty from any Toyota dealership. A vehicle is a big investment. Protect it with Vehicle Protection Plans available from Nucar Toyota of North Kingstown. Learn more now. your standard coverage, as well as additional coverage options. BASIC WARRANTY. 48MO / 50K MI. WHICHEVER OCCURS FIRST. POWERTRAIN WARRANTY. 72MO / 70K MI. Extended Warranty Coverage (items 1, 2, 3 and 4 above) transferable at no cost for added resale value. All important information clearly spelled out in your. Platinum Protection provides the most protection TFS offers after your vehicle's warranty expires, including parts not covered in Gold and Powertrain plans. Car covers are warranted for 12 months from the date of purchase and do not assume any coverage under the Toyota New Vehicle Limited Warranty. View Inventory. Each Toyota Certified Used Vehicle is reconditioned to Toyota's exacting standards by Toyota dealer-trained technicians and backed by an extensive used car.

At no extra cost to you, Hoover Toyota offers Lifetime Warranty, a non-factory, limited powertrain service warranty on all new and qualifying used vehicles. Warranty for a complete component/parts list and coverage details. Parts pricing listed in illustration is based on average off actual at a retail rate for. Experience the peace of mind that comes with high quality car service. Learn more about our warranty options including Powertrain, New Vehicle, & more. To provide you with additional protection against unexpected repair costs, we offer our range of Toyota Extra Care Protection (ECP) plans. This booklet will. This warranty covers repairs and adjustments needed to correct defects in materials or workmanship or any part supplied by Toyota, subject to exceptions. Extended Vehicle Care helps pay for costly repairs after your manufacturer's warranty expires Average cost of repairs without protection: Steering: $ Benefit from an extended new vehicle warranty plan, or take advantage Toyota dominated the list, securing 5 out of the 10 spots. This achievement. That's why Toyota offers Toyota Extra Care Protection (ECP) Service Here's a guide to Toyota Financial Service's current Wear & Tear pricing. coverage on our Ford Fusion and Toyota RAV4. We don't like how car inside view looking through windshield driving on the road. CarShield cost guide. The Lifetime Powertrain Protection plan gives you peace of mind by knowing your vehicle is protected. Learn more at Joseph Airport Toyota! All new vehicles come standard with ToyotaCare and can be covered under ToyotaCare * or ToyotaCare Plus * with the purchase of your Toyota. Nearly all vehicles. The battery begins life inside a Toyota vehicle, but since it can outlive the life of that vehicle, it can extend its value while also decreasing its impact. What Is Covered By My Toyota New Car Limited Warranty? When you purchase a new vehicle from Toyota, you are protected against defects in materials or. 6. Standard New-Car Financing Rates Available. 7. Extended Warranty Coverage (items 1, 2. Kendall Auto Protection provides a used car warranty in Bend, OR, roadside assistance, two oil changes, and money-back guarantee. Committed to its philosophy of always putting its customers first, Toyota Pakistan has introduced Extended Warranty packages till 5 years for its valued. Checkered Flag offers warranties on any vehicle from new to pre-owned to already-owned! Is that service bill a little steep, check the price of a warranty. For additional details, please refer to the Warranty and Maintenance Guide or speak to the Customer Relations Manager at your local Toyota dealership. (1). The best time to purchase protection for newer vehicles is while they're still under the original factory warranty, according to AAA. This helps keep the cost. Avoid out of pocket expenses for unexpected car repairs with our Extended Service Plans. Contact the staff of Sears Imported Autos, Inc. for various.

Gold Bullion Price Prediction

On average, the 38 surveyed analysts forecast a price of US$ 1, per troy ounce in This would imply a gain of % versus the average price level in. KITCO Covers The Latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rate, Mining News, ETF, FOREX, Bitcoin, Crypto. According to the latest long-term forecast, Gold price will hit $2, by the end of and then $3, by the end of Gold will rise to $3, within. Considering the gold price predictions for last year have already been soundly beaten, Citi's forecast of $3, doesn't sound outside of the realms of. Overall, gold is forecasted to average $2, in the third quarter and peak in the fourth quarter at $2,/oz, resulting in an annual average of $2,/oz. Mostly quoted in US Dollars (XAU/USD), gold price tends to increase as stocks and bonds decline. The metal holds its value well, making it a reliable safe-haven. Those looking to invest in gold understandably want a future gold prices prediction for the foreseeable investment period. The good news here is that as it. Stronger EUR/USD is bullish for all dollar-denominated precious metals including gold. Negative. Europe Consumer Services Index. United States Interest. Gold - data, forecasts, historical chart - was last updated on August 31 of Gold increased USD/t oz. or % since the beginning of On average, the 38 surveyed analysts forecast a price of US$ 1, per troy ounce in This would imply a gain of % versus the average price level in. KITCO Covers The Latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rate, Mining News, ETF, FOREX, Bitcoin, Crypto. According to the latest long-term forecast, Gold price will hit $2, by the end of and then $3, by the end of Gold will rise to $3, within. Considering the gold price predictions for last year have already been soundly beaten, Citi's forecast of $3, doesn't sound outside of the realms of. Overall, gold is forecasted to average $2, in the third quarter and peak in the fourth quarter at $2,/oz, resulting in an annual average of $2,/oz. Mostly quoted in US Dollars (XAU/USD), gold price tends to increase as stocks and bonds decline. The metal holds its value well, making it a reliable safe-haven. Those looking to invest in gold understandably want a future gold prices prediction for the foreseeable investment period. The good news here is that as it. Stronger EUR/USD is bullish for all dollar-denominated precious metals including gold. Negative. Europe Consumer Services Index. United States Interest. Gold - data, forecasts, historical chart - was last updated on August 31 of Gold increased USD/t oz. or % since the beginning of

Mostly quoted in US Dollars (XAU/USD), gold price tends to increase as stocks and bonds decline. The metal holds its value well, making it a reliable safe-haven. Forecasting rise and fall in the daily gold rates can help investors to decide when to buy (or sell) the commodity. But Gold prices are dependent on many. Kiyosaki presents a nuanced forecast for gold prices, predicting them to reach $3, in and $5, in He tweeted the following: ". Across our seven gold price predictions, we have an average predicted gold price of $2, per ounce, which would be a new all-time high. View our list of. “Gold prices could surge to $4, per ounce in as interest rate hikes and recession fears keep markets volatile. The price of the precious metal could. forecasts and news - updated on September of GoldPrice - Chart - Historical Data - News. Summary; Stats; Forecast; Alerts. Gold surged to around. A gold price forecast from TradingEconomics as of 16 May expected the commodity to trade at $2, by the end of the current quarter. The website's macro models. Gold Forecasts & Analysis · Gold Weekly Price Forecast – Gold Market Continues to See Stagnation · Gold Price Forecast – Gold Continues to Look Choppy · Gold. In order to predict the gold price in , we need to forecast three things: Realised inflation to ; Real rates in ; The premium to fair value. Everything you need to know to get started in Precious Metals ; Gold. $2, ; Silver. $ ; Platinum. $ ; Palladium. $ -. The long-term gold forecast is bullish. There are predictions that the price of an ounce may exceed $50 thousand. High demand is the main driver of. Daily Gold News: August 30 – Gold Still Trading Sideways Gold price remains near the $2, level; Core PCI Price Index data in focus. Winning Forecasts and Actuals ; Gold winner: Bruce Ikemizu (Japan Bullion Market Association). Gold: Actual Average Price $1, ; Silver winner. Based on our forecasts, a long-term increase is expected, the "GC" commodity price prognosis for Aug 24, is USD per ounce. With a 5-year. Gold price forecasts are about as reliable as any other type of prediction; you can make certain assumptions, but you can never forecast with complete accuracy. Gold price forecast update Gold price approached $ barrier, waiting for more decline to test $ level as a main negative target, to. David Wilson, head of metals research at Citigroup, says that gold should top $1, towards the end of the year as the “Trump reflation trade” reverses and. I'm going to keep stacking because gold has a lot of value, but the price is clearly being driven up in ways that make no sense, so I predict it. Investors typically view gold as a safe haven asset, and for this reason, the precious metal tends to become more popular in times of political and economic. Although this new record is a welcome development for precious metals investors, just within the last week a new signal has developed which may spell trouble.

Best Roth Ira Calculator

This calculator assumes that your return is compounded annually and your contributions are made at the beginning of each year. Are you considering converting your Traditional IRA to a Roth? Use the Roth IRA Calculator to assess your situation and determine which IRA is best for you. Use our Roth IRA Calculator and find out how contributing makes a big difference in your retirement savings. This IRA calculator assumes you know or can accurately calculate your Modified Adjusted Gross Income (MAGI) for a future contribution year. · In the event that. In our analysis, the best Roth IRAs overall are Fidelity and Charles Schwab Intelligent Portfolios. However, all of our picks stand out for their low costs and. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now, but withdraw the funds tax-free in retirement. Use our IRA calculators to get the IRA numbers you need. Compare IRAs, get Roth conversion details, and estimate Required Minimum Distributions (RMDs). ttass.ru provides a FREE k or Roth IRA calculator and other (k) calculators to help consumers determine the best option for retirement possible.'. Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually. This calculator assumes that your return is compounded annually and your contributions are made at the beginning of each year. Are you considering converting your Traditional IRA to a Roth? Use the Roth IRA Calculator to assess your situation and determine which IRA is best for you. Use our Roth IRA Calculator and find out how contributing makes a big difference in your retirement savings. This IRA calculator assumes you know or can accurately calculate your Modified Adjusted Gross Income (MAGI) for a future contribution year. · In the event that. In our analysis, the best Roth IRAs overall are Fidelity and Charles Schwab Intelligent Portfolios. However, all of our picks stand out for their low costs and. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now, but withdraw the funds tax-free in retirement. Use our IRA calculators to get the IRA numbers you need. Compare IRAs, get Roth conversion details, and estimate Required Minimum Distributions (RMDs). ttass.ru provides a FREE k or Roth IRA calculator and other (k) calculators to help consumers determine the best option for retirement possible.'. Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually.

Roth IRAs offer tax-free earnings, but contributions are not deductible. All fields are required. Current Traditional IRA amount. This Roth vs Traditional IRA calculator will help you compare the tax and investment consequences of each option so that you can determine the best account for. Our Roth IRA growth calculator provides you a simple way to see how much your Roth IRA will grow based on your contributions and your expected growth rate. Use this Roth IRA calculation method to determine your contribution limits for tax purposes Best Online Brokers · Best Savings Rates · Best CD Rates · Best. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable account. It is mainly intended for use by US residents. The Annuity Expert offers the ONLY free Roth IRA calculator that estimates growth for your retirement savings and calculates guaranteed income. Best Roth IRA accounts of September · Charles Schwab · Wealthfront · Betterment · Fidelity Investments · Interactive Brokers · Fundrise · Schwab Intelligent. Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. With a Roth IRA calculator, you can calculate how much your retirement savings account retirement accounts can help you determine which is the best option for. Should you have a Roth or Traditional IRA account? Our calculator will help you decide which IRA will provide the most income during retirement. Use these free retirement calculators to determine how much to save for retirement, project savings, income, K, Roth IRA, and more. Free IRA calculator to estimate growth, tax savings, total return, and balance at retirement of Traditional, Roth IRA, SIMPLE, and SEP IRAs. between a Roth IRA and a Traditional IRA. With that understanding, you can decide which IRA may best meet your investment expectations and financial needs. (See “Methodology, disclosures and footnotes” below for important information regarding key assumptions.) Account type. IRA. We have created a free Roth IRA calculator to help you estimate how much money you can save for retirement. There is no tax deduction for contributions made to a Roth IRA; however, all future earnings could be sheltered from taxes, under current tax laws. The Roth IRA. Roth IRA savings: · Starting balance · Annual contribution · Current age · Age at retirement · Expected rate of return · Marginal tax rate · Total contributions. This calculator can help you decide if converting money from a non-Roth IRA(s) — including a traditional, rollover, SEP, or SIMPLE IRA — to a Roth IRA makes. Using our IRA calculator, you can compare your options between a Traditional or Roth IRA. Adjust the values accordingly to help plan your retirement. This calculator can help you decide whether the Roth IRA would provide an advantage over a deductible IRA for your own situation.

1 2 3 4 5